Free cash flow can be defined as the cash generated by a company after it has taken care of the expenses that maintain the company’s capital asset and covers the company’s operations. Free cash flow is arguably the most important financial indicator of a company’s stock value. The value/price of a stock is considered to be the summation of the company’s expected future cash flows.

One advantage of using FCFF is that it includes all forms of cash flow. This means that it is a comprehensive measure of a company’s cash flow. Businesses may use the extra cash to pay down debt, repurchase shares, and acquire other companies, which are all ways a company can increase its value and profitability. They do this by estimating the company’s future cash flows and discounting them back to the present. Up-to-date, accurate financial statements are foundational for effective planning and management. Both measures have their place, and each one deserves consideration alongside the other.

What is the free cash flow conversion formula?

Analysts

often use more than one method to value equities, and it is clear that free cash flow

analysis is in near universal use. One disadvantage of using FCFF is that it includes capital expenditures in the calculation. This can be difficult to estimate, especially for companies with long-term projects. Equity investors like to keep an eye on companies that have minimal debt and lots of liquid assets.

While some use it to invest in the growth of the company through acquisitions. In other words, free cash flow to the firm is the cash left over after a company has paid its operating expenses and capital expenditures. Cash flow is critical to financial health and performance and vital to running a successful business. However, as the Chaser late payments report shows, companies worldwide struggle with late customer payments.

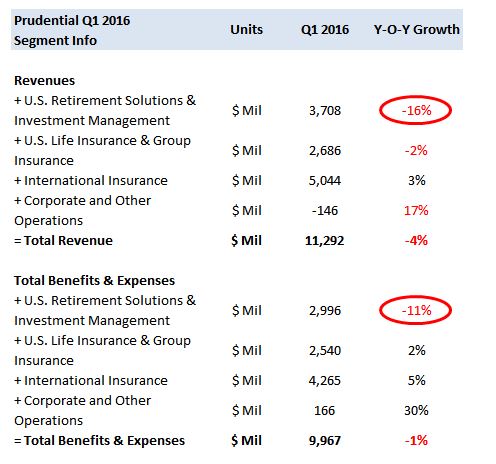

Exhibit B – Income Statement and Cash Flow Items

This is because when the price of a share is low and the free cash flow is improving, the odds are good, indicating that earnings and share value will soon be on the rise. Hence, a high cash flow per share value means that earnings per share would potentially be high too. Once the firm’s value is calculated, a firm’s equity value can be calculated by subtracting the market value of a company’s debt. In other words, it is the amount of money available to pay holders of a company’s equity (stock). Let’s use a real-world example and calculate the cash flow from operations for Apple Inc as of September 2021.

T-Mobile US (TMUS) Q2 2023 Earnings Call Transcript – The Motley Fool

T-Mobile US (TMUS) Q2 2023 Earnings Call Transcript.

Posted: Fri, 28 Jul 2023 00:30:33 GMT [source]

Therefore, you’ll find that unlevered free cash flow is higher than levered free cash flow. Levered free cash flow assumes the business has debts and uses borrowed capital. Because it doesn’t account for all money owed, UFCF is an exaggerated number of what your business is actually worth. It can provide a more attractive number to potential investors and lenders than your levered free cash flow calculation. You have operating cash flow, discounted free cash flow, and both levered and unlevered free cash flow.

Free Cash Flow to the Firm Calculation

So, this makes free cash flow an essential metric for identifying companies that are growing with high up-front costs which may affect earnings in the present but have the potential to pay off in the future. Unlevered free cash flow (UFCF) is the cash available after all expenses are paid but before debt obligations are paid. In other words, it is the amount of money available to pay both holders of a company’s equity and debt. FCFF represents the cash available to investors after a company pays all its business costs, invests in current assets (e.g., inventory), and invests in long-term assets (e.g., equipment). FCFF includes bondholders and stockholders as beneficiaries when considering the money left over for investors.

- In this calculation for free cash flow, the income statement, cash flow statement, and balance sheet are used.

- It’s a company’s FCFF that gives us an insight into its ability to reinvest in itself and continue to produce value for its shareholders.

- If the cash flow statement isn’t available, CFO can be derived by starting with net income.

- Free cash flow is an important measure of how well-positioned a company is to pay down debt or make strategic investments that could improve its competitiveness.

- To arrive at the FCFF figure, a Financial Analyst will have to undo the work that the accountants have done.

- After doing so, we add back the tax-adjusted interest expense, following the same logic as the prior formula.

FCFF is an important part of the Two-Step DCF Model, which is an intrinsic valuation method. The second step, where we calculate the terminal value of the business, may use the FCFF with a terminal growth rate, or more commonly, we may use an exit multiple and assume the business is sold. A study of professional analysts substantiates the importance of free cash flow valuation

(Pinto, Robinson, Stowe 2019). When valuing individual equities, 92.8% of analysts use market multiples and 78.8%

use a discounted cash flow approach. When using discounted cash flow analysis, 20.5%

of analysts use a residual income approach, 35.1% use a dividend discount model, and

86.9% use a discounted free cash flow model. Of those using discounted free cash flow

models, FCFF models are used roughly twice as frequently as FCFE models.

Free cash flow calculation

EBITDA can be quite helpful in comparisons of similar companies’ performance, because it strips out external factors to allow a focus on the financial results of management and operational strategies and decisions. EBITDA offers a way to judge a company’s profitability at a sort of baseline level. On the face of it, free cash flow, the bottom line, and EBITDA can seem like the same thing. They each measure different aspects of a company’s financial performance. Then we have free cash flow, which is the difference between those cash inflows and outflows.

In cases where a small business does use external funding, those lenders have leverage, which is where we get the words levered and unlevered. The cost of equity is the required rate of return required by holders of a company’s common stock. Levered free cash flow is essential because it is the firm’s equity value, i.e., what the company is worth to equity investors. It is essential because it is the cash flow available to all providers of a firm’s capital, i.e., when a firm issues bonds, the investors give it money in exchange for bonds. So, it tries to get you the best of both worlds (and the flip side is that it retains the problems of both, as well). EBITDA, for better or for worse, is a mixture of CFO, FCF, and accrual accounting.

Projection Period

One of the most commonly cited terms in any discussion of a business’s solvency is cash flow. You can see how UFCF can be a negative figure but not necessarily a negative implication about your business. Predictably, the first year required more CAPEX, but you were able to recuperate during the second year and generate a positive UFCF. So, in this context, unlevered means the small business hasn’t borrowed any capital necessary to start and fund their operations. In other words, they completely own all of their capital and assets.

If the cash flow statement isn’t available, the income statement and balance sheet may be used to calculate CFO using net income as the starting point. If the cash flow statement isn’t available, CFO can be derived by starting with net income. However, it is important to remember that cash flow from operations (CFO) is not the same as free cash flow, but it is part of the free cash flow formula. It is also an indicator that a company will generate sufficient cash flows to satisfy its current and future obligations and potentially pay extra money to shareholders. Thus, you may be left incorrectly assuming that the higher ROIC company is overvalued. It’s measured as the net amount of cash (the total amount of money coming in less the total amount of money going out).

To calculate FCFF starting from earnings before interest and taxes (EBIT), we begin by adjusting EBIT for taxes. This may be due to a number of factors, such as different business models or operating efficiencies. The investment world is one that is inherently risky and financially dangerous.

At its core, it tells you whether you’re profitable and can generate the capital needed to continue running your business. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Earnings before interest and taxes (EBIT) can also be used as the starting point to calculate free cash flow. The starting point for calculating free cash flow will vary depending on the availability of the cash flow statement. CapEx can be found on the cash flow statement and is categorized as investing activities or cash flow from investing (CFI).

- Levered free cash flow is essential because it is the firm’s equity value, i.e., what the company is worth to equity investors.

- However, it is important to remember that cash flow from operations (CFO) is not the same as free cash flow, but it is part of the free cash flow formula.

- Companies that don’t usually make long-term investments as part of their business model will be more in line with using net income as an indicator of financial performance.

- In some instances, special considerations may be taken into account if you have long-term investments.

- Two identical companies can have very different income statements if the two companies make different (often arbitrary) deprecation assumptions, revenue recognition and other assumptions.

Low free cash flow is not necessarily negative as it may indicate the company’s growth and expansion. Free cash flow to the firm (FCFF) is a metric used to measure a company’s ability to generate cash flow. FCFF takes into account all of a company’s fcff formula from ebitda expenses, including CAPEX (capital expenditures) cash outlay. The free cash flow of a company is the cash generated by the company after it has taken care of the expenses that maintain the company’s capital asset and covers the company’s operations.

Laisser un commentaire